At 9.00 a.m. on Tuesday, 30th November 1999, instead of rush hour traffic the streets of Seattle in America were blocked by 25,000 anti-globalisation protesters trying to prevent World Trade Organisation (WTO) delegates from attending the opening ceremonies at Paramount Theatre. In 2003, at another WTO multilateral meeting for free trade, this one organised at Cancún in Mexico, Kenyan representatives walked out of the negotiations resulting in another breakdown of talks. The Economist lamented this second collapse of free trade negotiations in four years a "mortal blow to the multilateral trading system itself - a system that, for more than half a century, has underpinned global prosperity". Free trade is considered by several economists to be one of the more powerful, uncontroversial and truly profound concepts in economics. Why, then, do so many voices from developed as well as developing countries condemn globalisation and free trade?

Birth of an idea

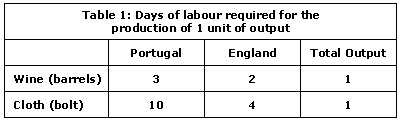

In the early nineteenth century, the English economist David Ricardo revolutionised economics with his theory of comparative advantage. He demonstrated the benefit which can be enjoyed by any country if it were to move from a completely closed economy to free international trade by specialising in certain products. He also showed that this static advantage would exist for each and every nation, even if one country were to be superior to another in all production processes. Take the hypothetical example in the adjoining table, for example. Let us assume that England is technologically better than Portugal in making both wine and cloth. But according to Ricardo, England should utilise all its resources in the production of cloth in which it enjoys greater efficiency than Portugal than it does in the case of wine. Additionally, specialisation in cloth will also enable England to gain the advantages of large scale production.

This is similar to a doctor employing a secretary to type letters which she could have done more quickly herself. As a doctor, she would be utilising her time better and earning more by devoting her time exclusively to medicine rather than spend 20 minutes in typing a letter, even if her typing speed is faster than that of her secretary. This seemingly straightforward reasoning however rests on a number of assumptions, which contain unspoken value judgements or are plain unrealistic.

This is similar to a doctor employing a secretary to type letters which she could have done more quickly herself. As a doctor, she would be utilising her time better and earning more by devoting her time exclusively to medicine rather than spend 20 minutes in typing a letter, even if her typing speed is faster than that of her secretary. This seemingly straightforward reasoning however rests on a number of assumptions, which contain unspoken value judgements or are plain unrealistic.

Static or dynamic gains

An important conclusion of comparative advantage, which often escapes recognition, is that it suggests that Portugal should specialize in producing wine even though its output is less-efficient, and possibly less delicious, than British wine! To extend this logic, if this inferior technology was for the production of more important commodities than wine, for example; the production of life-saving pharmaceuticals, or progress in food production, or advances in telecommunications, the theoretical justification for ignoring the superior technology due to rigid adherence to the principles of static comparative advantage falls apart.

Free trade theory also argues that the transition from a closed door economy that doesn't trade very much, to one that trades openly in a specialised product, is universally beneficial. But this advantage is only a static one-time gain due to transition. In the long run, there is every possibility that the income levels in Portugal and England will fall below their respective hypothetical closed door existences, leading to dynamic losses. Instead, it would be in the best interest of both economies to specialize in sectors in which they possesses the highest comparative rates of growth of productivity rather than static comparative advantage.

Who wins and who loses?

The recent spurt in outsourcing of service sector jobs from America is therefore nothing but a natural outcome of the underlying assumptions of free trade. Even though trade theory suggests that corresponding compensating jobs for labour will be created in the import sector, that presumption is based on the existence of perfect balance of trade. In reality, however, such assumptions are hard to fulfil. By treating labour as a commodity, the costs for displacement of workers like retraining, job search, lost production, compensation, emotional costs, etc. are not accounted for by trade theory. These unsaid edicts of free trade lie at the root of the anger of retrenched workers in the West. In the recent past, India has been the target of protectionist sentiments, which were previously directed at China in the late nineties for its cheap manufacturing exports and undervalued currency, and Japan in the mid-eighties for its sophisticated technological exports.

One size doesn't fit all

Also, in the real world if too many countries were to increase their exports of the same commodity while chasing their individual comparative advantages, the market would become glutted and prices would fall. The slump in the world prices of coffee to a hundred-year low in 2002 is a typical example of such dynamic changes. The break-up of the three decade-old cartel of coffee producers, the growth of Vietnam as the second largest producer of coffee, the new technique of steam-cleaning in the production of instant coffee with the use of beans of inferior quality and the lowering of the standards by the London Commodities Exchange all collectively caused the market price to crash. While these changes resulted in huge losses for farmers in all producing nations who are barely able to recover their cost price, the multinational corporations emerged as the primary gainers as the new efficient production technique enabled them to use the inferior seeds with higher profit margins.

Thus, while the regenerative process of creative destruction is considered to be one of the hallmarks of free trade, the distribution of costs and benefits has a tendency to be grossly lopsided. Traditional trade analysis, due to its static framework, ignores the dynamic effects of progress, accumulation and technical change, and the fact that free trade, sa practised, doesn't necessarily benefit all nations even in the aggregate.

The Real World Trading System

Despite the various lacunae in the theory of free trade, a formal world trading system was born in 1947 with the formation of GATT (General Agreement on Trade and Tariffs) based on the principles of comparative advantage. Its founding fathers believed that it is universally advantageous and efficient to negotiate trade agreements on a multilateral platform. Today, the successor to this system, the World Trade Organisation (WTO), is teetering on the brink of collapse.

On the one hand, the World Bank estimates that had a successful multilateral negotiation closed at Cancún, it would have raised global incomes by more than $500 billion a year by 2015, and that 60 percent of that gain would have gone to poor countries, enabling 144 million people to cross the poverty line. They also conclude that a majority (70 percent) of this gain would have come from freer trade among the poor countries themselves.

However, dependency theorists who sit in the opposite camp argue that rich countries gain more from trade than poor countries. For one, developed countries export manufactured products, whose productivity can increase multi-fold with every technological advance. These productivity gains mean that workers and capitalists in rich nations enjoy better bargaining positions to demand higher wages and profits. Also, it has been universally observed that as income rises, the increase in demand for primary commodities (foodgrains, tea, etc.) is small while there is a huge rise in demand for manufactured commodities (cell phones, cars, computers, etc.). This, in turn, means that goods manufactured in developed countries find a much higher price through trade than those made in poorer nations. Dependency economists therefore argue that the system of world trade perpetuates the underdevelopment of poor nations. They have, as a result, proposed policies of inward-oriented industrialisation (similar to protectionist production in Nehruvian India) or even the extreme step of disconnecting from the world trade system.

At the same time, legitimate protectionist measures (such as patents, copyrights etc) designed by the WTO to compensate innovators for research and development costs and to provide temporary monopoly profits as incentives have grossly compromised on societal well-being in their application. A staggering 40 percent of the population of Botswana are infected with the AIDS epidemic, but the patent regime and US political pressure restricts them from obtaining drugs from India, which produces generics at a fraction of the cost of branded drugs.

Redefining Utopia

While the future of the world trading system hangs in the balance, it is a good time to revaluate the fundamental precepts that underlie our global world. This analysis attempted to show that free trade theory has a number of assumptions which are either disconnected from reality or contain unspoken value judgements. Also the translation of theory into practice is imperfect. What is now required is redefinition of trade from the perspective of societal welfare rather than that of highly vocal power groups who gain advantages in the name of national interests. Comparative advantage can find merit only when there exists a level playing field; without this economic disparities across the globe are only likely to worsen.