You can bank on it

Pritha Sen on how a group of asset-less rural Marathi women have

created a bank for themselves.

September 2002

Years of hardship and backbreaking labor in the drought-stricken agricultural fields of Mhaswad village in west central India have worn 64- year-old Sumantai Limbrao Gaekwad to the bone. A single woman by choice, she walked out on her husband two decades ago and survived as a daily wage laborer earning a miserable 2.10 rupees per day.

|

| Sumantai and her grand-daughter (Photo credit - Pritha Sen) |

Yet Sumantai's eyes sparkle today with a new zest for life. Perfectly turned out in a traditional silk sari, her jewelry-laden daughter in tow, the sexagenarian says: "All that's in the past now. I have built my own house and have my own flowers and condiments shop in the temple complex."

Sumantai's story captures in a nutshell how a group of asset-less, rural women have created, and now operate, a bank for themselves. The Mann Deshi Mahila Sahakari Bank (Mann Land Women's Cooperative Bank) of Mhaswad village is unique in the fact that it is the country's first rural cooperative bank of its kind – for and by women.

The absence of a formal education has not deterred these women from managing a system of microcredit that is suited to their needs when the big nationalized banks have failed to see any value in serving them. In the process, they have changed the quality of life in their villages by empowering themselves economically, educationally and politically. Now, even the big nationalized banks want them as clients.

Passport to a Better Future

Today, Sumantai earns 25 rupees per day, and she can make up to 300 rupees on weekends. "I have been able to pay back both my loans of 5000 and 20,000 rupees, borrowed from the local Mahila Bank (Women's Bank) for the shop and the house," she notes with pride.

Although she is illiterate, Sumantai's thumb impression serves as her passport to a better future when banking at the Mann Deshi Mahila Sahakari Bank (MDMSB). It is the first such rural Mahila Bank in all of Maharashtra, the Indian state that includes Mumbai (formerly Bombay).

Eighty percent of the MDMSB's customers are from the marginalized classes. India's other rural cooperative banks are operated by the government and are dominated by the upper caste. Unlike the MDMSB, they do not extend microcredit tailored to women's needs.

Sumantai's rising fortune is a story that has been repeated hundreds of times in the lives of women who live in the hamlets surrounding the one-horse village of Mhaswad, located 250 miles from Mumbai in the Mann subdivision (group of villages) of Maharashtra state's Satara district. In less than five years, since it was founded in August 1997, the MDMSB has transformed the Mann subdivision, enabling women to emerge as powerful catalysts of change.

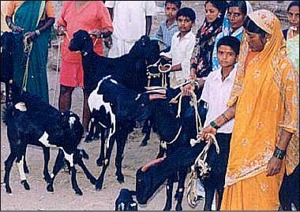

|

| A goat show organized by the Mann Deshi Mahila Sahakari Bank (Photocredit - MVSS) |

The MDMSB was founded by illiterate, rural women who won a hard-fought battle for a banking license from the Reserve Bank of India (the top regulatory bank in India). Since then, it has grown from having an initial shareholder capitalization of 600,000 rupees to a bank with total assets that reached 30 million rupees this year, with 2.4 million shares outstanding. At the end of the current financial year (March 31), MDMSB posted a net profit of 400,000 rupees, signifying that it has produced a surplus after recapturing all of its initial and current operating costs.

The MDMSB's customers are drawn from the region's unorganized sector of women who are small producers – vegetable vendors, milk vendors, nomadic goat and sheep farmers, cottage industry entrepreneurs, casual laborers and daily wage earners – a multihued, essentially asset-less, and uneducated client base.

By the late 1970s, Mhaswad village was stricken by drought, and the entire Mann subdivision was reduced to one of the most poverty-stricken areas of Maharashtra state. It was during this period, in the mid-1980s, that Chetna Gala Sinha, a 42-year-old firebrand activist who was born and raised in Mumbai, arrived in Mhaswad after falling in love with a well-known Mhaswadi farmer-activist who is now her husband.

Mhaswad was once a prosperous village with a thriving handloom weaving industry and productive cotton fields. By the time Sinha had arrived, it had shrunk to a community of primarily goat farmers, shepherds and daily wage earners.

The number of men who were migrating out of the village during the dry season was soaring. They left in droves to go to towns where they could work as casual workers in sugarcane factories, or to Mumbai to work in construction, or to simply move with their cattle to other states.

"Women were the worst hit by the migrations," Sinha said. "It left them holding the baby and the bathwater as well!"

Forging Links and Building Political Clout

Sinha began working in Mhaswad as an activist in the late '80s, tackling immediate problems such as the water shortage, wage-related issues, and government relief schemes offered during periods of drought. Having earned a degree in business, Sinha soon realized there was an urgent need for a sustained effort to help the local people develop assets and slow the rate of out-migration.

She created the Mann Vikas Samajik Sanstha (Mann Social Welfare Organization). In 1992 she used the organization to launch a general credit cooperative society that provided a weekly savings scheme for women from the marginalized classes. The women pooled their savings from one week and went as a group to the weekly market where one of them bought a goat.

"We started with a minimum contribution of 5 rupees per person, but the women came up with at least 10 rupees weekly," Sinha said. "The recovery rate was excellent – almost 100 percent," she beams.

The women were now doing business, and their groups spawned Self Help Groups (SHGs) that consisted of at least 20 women each. The SHGs expanded and concretized the concept of inter-credit facilities, allowing the women's collectives to go beyond generating capital and assets – forging linkages in the market and developed a bargaining clout that they could use to their advantage.

|

| A Self Help Group (Photocredit - MVSS) |

As women assumed the role of managers of their family finances, they began to realize their potential. Women emerged from the SHGs as leaders and they soon created a federation.

Today, the SHGs have spread to 126 villages in the Mann subdivision, covering an area with a population of 250,000. The federation acts as a pressure group that influences market forces and supports expansion of income-generating activities. Federation members are emerging as local political leaders.

By 1996, the federated women's cooperatives recognized they needed the services of a bank. Unfortunately, the loan and credit facilities of India's nationalized and private banks are mired in red tape. They immediately disqualify illiterate women, especially when they lack assets that would serve as solid collateral, and the paperwork and processing is beyond their comprehension.

In any case, no bank would be interested in extending a loan to buy a goat or a garden umbrella, Sinha notes. So Sinha approached the Reserve Bank of India for a license to start a women's bank. She was initially met with a firm refusal.

Inculcating a New Culture of Savings

Sinha persisted. Her argument was simple: women traditionally have handled the finances of the family, and have done an excellent job of it. Why was it so difficult to believe that they could handle a bank? After two years of persistent effort, the Reserve Bank of India relented and the MDMSB became a reality. In retrospect, Sinha says, "You just need to have shareholders come together and create a capital. Even poor people can create such collectives and improve their lives without outside interference. We started with 500 women who put in, on an average, 500 rupees each and managed to come up with the initial 600,000 rupees."

Organizing the bank was no cakewalk. "I realized as I was inculcating a culture of savings among these women that one has to train them through their habits, their lifestyle," Sinha said. "One cannot impose anything new from above."

Making the MDMSB profitable, and ensuring that the women had money to save, required understanding, creating and developing the market, Sinha said. It also was vital to create a discipline of saving and planning for the future within the community, she said.

The SHGs gave Sinha the platform she needed to campaign for and inculcate these habits. The MDMSB has reinforced these efforts by continuously offering new products to its customers. Its plans to offer an old age social security scheme and link-ups with insurance companies for subsidized policies have been well received. "An accident insurance policy which we had introduced has worked very well, and there haven't even been claims," Sinha noted.

Understanding the market, identifying income generation niches and developing them was not so difficult, Sinha said. Because raising animals is entirely a woman's responsibility in India, as is the job of selling produce at the weekly markets, the MDMSB team visited the weekly markets in the area to discover how women could work there, and what they wanted.

The exercise uncovered some interesting information. The MSMSB team found that women work with the smaller goats and sheep in the animal markets, and sometimes even buffaloes, while men work with the bullocks that are used to till land. But bullocks have lost their market value with the decline in agriculture.

Most women felt it was better to have two buffaloes and a couple of goats in the house than bullocks that cost nearly 25,000 rupees each. With men migrating out of the villages in droves, the women were left to tend the bullocks – a labor-intensive job that is pointless in times of drought. Thus the MDMSB decided to emphasize animals that women can control as an asset and that generate income, such as milk cows, goats and buffaloes.

Before women began participating in the MDMSB, the income earned from milk sales was controlled by the men, Sinha said. But now that the MDMSB is extending loans to women only, and has launched an effort to create nine Mahila dairies (women's dairies), women are selecting the type of cattle that is best suited to them. The women supply milk to the Mahila dairies, which ensure that they receive a fair price and that proceeds are disbursed in their name.

Vegetables: A New Repertoire

The MDMSB identified the growing and vending of vegetables as a second area of income generation for women, and many women have opted to grow and sell, or buy and sell vegetables. Now, a whole new repertoire of vegetables has emerged – apart from the traditional leafy vegetables, brinjals, and onions – such as tomatoes, varieties of cucumber and gourds, and okra, and even grapes are being cultivated.

Today, there are hundreds of success stories. Sindhutai Vilas Dhaure, 42, of Mhaswad village was married to a tailor with hardly any earnings. "But I had to survive and provide an education for my son as well," she said.

Dhaure took a loan of 30,000 rupees from the MDMSB to start a business of selling sprouted lentils and beans, which are considered cheap yet highly nutritious food items in India, and are consumed liberally. Beginning with an initial investment of 9-11 pounds of vegetables per day, which she soaked overnight so they would sprout, she supplied them in packets to local households, small vendors, tea stalls, hotels and restaurants.

|

| Sindhutai Vilas Dhaure (Photocredit - MVSS) |

Sindhutai now sells an average of 110 pounds daily and her net income has jumped from the initial 600 rupees to 2,500 rupees per month. "I save 50 rupees daily at the bank," Sindhutai said. She has slowly built up her assets, including a color TV, a Godrej steel almirah (cupboard) that is a premium brand in India, and some gold.

"I spent 85,000 rupees on my son's wedding," she says proudly.

Kamal Jaisinh Gore, a vegetable and milk vendor, is a widow with two children. She took a loan of 5,000 rupees from the MDMSB to buy a buffalo. She managed to return the money before the expiry date of repayment.

Gore saves 10 rupees a day at the MDMSB. "Earlier, we were at the mercy of the local moneylenders who charged an interest rate of 5 - 6 percent," she said. "The bank charges only 1.5 percent, and it has made life so much easier for us."

Although vegetable patches are relatively easy to maintain, the area's agriculture has been in a sorry state, primarily due to drought. The MDMSB decided to try encouraging animal feed and fodder as a cash crop.

"We invited an agricultural expert to come and train us in fodder cultivation and in recognizing what makes good fodder," Sinha said. One of the lessons learned was that goats eat a certain kind of cactus during the summer months, so this was adopted as one of the fodder crops.

Discovering New Possibilities

The MDMSB identified selling bangles as a third promising area for women. While banglemaking is not a major industry in these parts, bangle selling has great potential because bangles are considered to be auspicious and daily wear for women, specially married women. They are considered mandatory on auspicious days and festive occasions.

Other ideas followed. The MDMSB extended loans for sewing machines because they are portable. Women could even sit in the marketplace with their machines and get ready customers.

These women are discovering new possibilities for generating income generation with the provision of small loans for making packaged powdered spices, potato and lentil wafers, buying chutney-making machines, etc. The MDMSB is considering financing a Mahila Bazar (women's bazar) that would be run exclusively by women.

"You'd be surprised," Sinha said. "There are four computer institutes in Mhaswad. Three of them are run by local women today who have started them with loans from the bank."

By custom, the majority of women who have developed businesses were not entrepreneurs, and their incomes were way below the poverty line. Those who had an income typically were earning about 180 rupees per month. Today, Sinha says with obvious pride, their income averages at least 1,200 rupees per month.

Despite the MDMSB's successes, it's activities have not halted the problem of out-migration thus far. During the past four years, "we have been able to control only about 30 percent," Sinha said.

Men continue to leave, primarily due to a lack of drinking water in certain areas during the dry months, the need for additional income, Sinha said. "But," she adds, optimistically, "we foresee a steady decline as our schemes lay down roots."

Nevertheless, there has been a visible change in attitudes, adds Sumantai, the sexagenarian seller of flowers and condiments. "Earlier, women did not have access to extra money," she said. "Now with the bank and the SHGs, they have a new confidence in their abilities. Women are also counseling each other on future security for their families and children. Girl children are encouraged to study and not just do housework."

Sinha agrees. "We have definitely been able to influence two things: education and awareness of basic rights. Once women are economically independent, they are empowered and have decision-making powers."

|

| Loan transactions in progress (Photocredit - Pritha Sen) |

Sinha is aware that there is a risk of saturating the market. Thus, she is determined to begin involving government agencies to help look for ways to ensure that all these entrepreneurial activities do not cancel each other out. India's recently enacted import-export policy opens new horizons in this regard: it aims to bring small producers under its fold and to give them an opportunity to connect with the global economy.

Partner as Collateral

The success of the bank raised concerns about whether whether the women would be intimidated by calculations of interest, the minimal yet mandatory paperwork, collaterals, and other such issues that arise when dealing with a licensed institution. "Paperwork is kept very simple and all calculations are done in rounded figures – 10, 15, 20," Sinha said. "We have also tried to keep to the local usages – we never say something like '58'; we always say 'two less than 60'"

When making large loans, the MDMSB cleverly uses a husband as collateral. In case of default, he is held as much responsible as the wife. Beyond this, the husband must sign a document that declares his wife is equal owner of any property they own. "This is a part of our empowerment program," Sinha said.

One reason for the MDMSB's profitability is that its spread is higher than nationalized banks-the client base that is-and therefore profits have risen quickly. Even though interest are as low as 1.5 per cent to 4 per cent. " Starting in mid 1997, it took us just four years to come out of our primary expenses and this year we have posted a net earning of Rs 4 lakh," says Sinha.

The secret of the MDMSB's success lies in the various products and services it offers, and the manner in which credit is extended with an eye to income generation and sustainable development, Sinha said. "We are focused on the fact that whatever we are doing is to strengthen and empower the people, and on asset building. When this realization strikes, the collective moves and grows."

The MDMSB's future plans include financing a mobile veterinary service, developing a federation of the Mahila dairies, distributing thermometers to milk vendors to assess quality of milk, issuing identity cards to MDMSB customers to make them socially and economically visible, and working closely with the government to raise awareness about the value of this type developmental finance.

One major breakthrough has already occurred at the policy level where some nationalized banks now approach women served by the MDMSB, offering credit with for animal husbandry. The MDMSB's success made them realize that these women are also quality customers.

Sinha smiles when asked whether it was difficult to establish her credentials and credibilty when she first started to work here. "You don't need to work hard to earn trust and credibility," says the woman, who is affectionately referred to as Bhabi (brother's wife) throughout the area. "In villages, everyone knows what you are up to and how – whether inside the house or outside. If your efforts are genuine, you are a winner all the way."

Pritha Sen

September 2002

Contact Chetna Gala Sinha at Mann Vikas Samajik Sanstha, Taluka Mann, District Satara, Maharashtra-415509. Tel: +91-2373-70119/70141. Pritha Sen is a Delhi-based freelance journalist. She was formerly with the the Indian news-weekly Outlook. Currently she is also a consultant to Ashoka, as Media strategist and chief editor of the soon-to-be launched Ashoka India Web site.

This article comes to India Together by arrangement with Changemakers.net. It was originally published in the Changemakers Journal.- Related: Economy issues homepage

- Feedback: Tell us what you think of this article.