Informal credit markets flourish because they offer the borrower what the formal market does not: access to money. The needs of the urban poor are often urgent. Therefore, availability and timeliness of credit are more important than the interest cost at the time of borrowing. To understand how informal credit markets serve the urban poor, it is necessary to first understand informal economies.

According to the UN, the informal sector in any economy is characterised by: ease of entry, reliance on indigenous resources, family ownership, small scale operations, use of labour intensive, local and adapted technology, use of acquired skills, unregulated market, competitive market. Small-scale production is clustered with allied services to form multiple economic nodes spread out across urban areas. These nodes often make use of home-based enterprises and unskilled migrant workers. Housing settlements develop around these economic nodes. Slums become a convenient place for the urban poor to live and work because of the close proximity of work opportunities, friends, family and other resources that reduce travel and other transaction costs.

Urban credit markets are significantly different from rural credit markets because income opportunities are varied, the cash economy is bigger and the number of bank branches is greater. Urban credit markets are more contiguous than rural markets, therefore borrowers ought to have more options than they would in rural areas. However, this has remained unutilised despite its potential, because of the paucity of policy initiatives towards issues of urban credit.

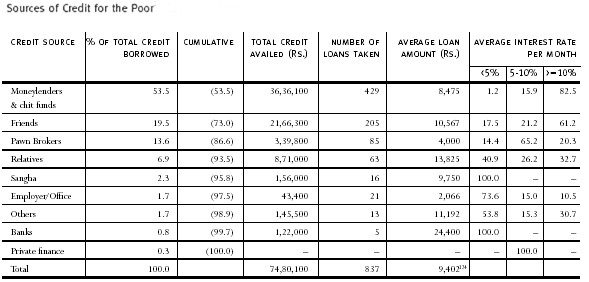

This is illustrated by a survey conducted by the Paradigm group in Bangalore. The source of more than 93.5% of credit is from the informal sector, which as mentioned earlier, often charges phenomenally high interest rates. The formal banking sector provides only 0.8% of the total credit. This is despite the fact that urban areas have many bank branches. The table below shows credit taken from different sources.

Loans from local moneylenders and pawnbrokers are conveniences. The lender often lives or has an agent who lives, within the borrowers community and understands the borrowers financial situation and constraints. Loans may be short term and exchanges of money may be done near home. This source is also not restricted by delays; money can be borrowed almost immediately in case of emergency. However, interest rates are seen to be exploitative as the moneylender might exercise monopoly power in the slum. For example, street hawkers and vendors often take one-day loans, borrowing Rs.90 in the morning, using it to buy goods to resell and returning Rs.100 at the end of the day. As long as the borrower earns more than the Rs.100 to be repaid, the transaction is considered beneficial to the borrower. But the borrower has paid 11.1% interest that day, which is equal to an annual percentage rate of approximately 4056 per cent using Simple Interest calculations.

Although at a very high price relative to formal credit markets, the moneylender also provides a service to consumers in terms of greater timeliness and convenience. Without competition and adequate supply from formal markets, the demand for credit spills over into informal markets. Criticism of the interest rates that moneylenders charge often ignores the direct costs of acquiring funds to loan as well as the opportunity cost of these funds. High interest rates also attempt to recover lenders transaction costs and the high risk premium or the average default rate. This is a premium that lenders charge all borrowers to compensate for default by some borrowers, they calculate this premium by dividing the principal and interest lost over a period of time by the total lending. Apart from that, there are monopoly or supernormal profits that form part of the lenders income from interest.

Borrowings from Self-Help Groups (SHG) are also very low. This may be because the loans taken from the moneylender may have been borrowed before the formation of the SHG. Secondly, any SHG will be unwilling to sanction larger loans, since the SHG itself may not have the required funds for lending to all the members according to their total needs. Additionally, the SHG invariably relates the loan sanction to the earnings, savings and repayment capacity of the borrower.

Some conclusions about the financial needs of the urban poor

1. The poor exhibit the preference for reducing transaction costs even at increased interest rates. Transactions costs, such as transportation, lost work/wages to go to a bank during working hours and negotiating with a bank manager, could be as expensive as the moneylenders rates. By serving customers in their neighbourhood, their workplaces or even at their front doors, these informal services reduce transaction costs.

2. Cashflows are as important as the total amount of credit. The poor prefer short-term borrowings to long-term credit. Informal credit is often shorter term and can be rotated more easily. Long-term loans given by the formal sector reduce the possible rotation of capital by the individual.

3. Social ties act as collateral, as seen from successful rural microcredit programmes. However, the structure of relationships among the urban poor, often migrants, are not as well understood or tested. More research needs to be done to understand these ties.

4. Frequent, small amounts are easier to save.

5. The best informal financial services are those that do not alienate illiterate customers and efficiently communicate various options, rewards and penalties.

6. Innovation and response expand credit market size. Informal credit markets recognise the importance of religious events, social customs and the expenses that accompany them; whereas formal markets currently do not sanction loans for a religious pilgrimage, for example, informal markets will provide credit for this activity.

7. Leadership and management when offered along with credit, make it attractive.The leadership given by informal credit rotation and savings organisers and chit fund managers is valuable, perhaps because the poor have few other alternatives that they perceive to be trustworthy and fair. This is despite the fact that there are many instances of chit fund organisers cheating the public. Likewise, the capacity-building activities of NGO microcredit efforts help develop leadership and management abilities among the poor.

The most significant insight from studying these markets is that the poor are bankable .Any delivery mechanism of financial services (be it an individual institution, a network or a policy) that possesses many, if not all of the features mentioned above will find substantial demand among the urban poor and comfortably meet the threshold of economic viability. In fact, NGOs around the world have led the campaign to expand banking services to the poor. There are many successful examples of microcredit programmes in rural India, but few have had a specific focus on urban India. One successful urban effort is SEWA (Self-Employed Women's Association) Bank in Ahmedabad. It has an impressive record of mobilising savings, making loans and empowering groups of women. And as with other NGO-led efforts around the world, repayment rates are much higher than for credit schemes created by the government and delivered by unwilling banks.

Urban credit demand

There have been only a few analyses of the need for credit in urban areas and more data needs to be collected. According to a 1998 publication by Paul B McGuire, John D Conroy and Ganesh B Thapa, 2.5 crores poor households in India require Rs. 15,000 crores over nine years until 2005. In a study conducted by Mahajan and Nagasri the demand for credit was found to be Rs. 9,000 per annum per household among the urban poor. In the Paradigm Group survey, average credit availed by each household was approximately Rs. 10,071 per annum. This figure was more than one-third of respondents average annual family income, a high debt to income ratio. Multiplied by official estimates of the number of poor households (at 5 persons per household), these two estimates (of Rs.9,000 and Rs.10,071), give a range of Rs.13,740 crores to Rs.15,360 crores annual credit demand.

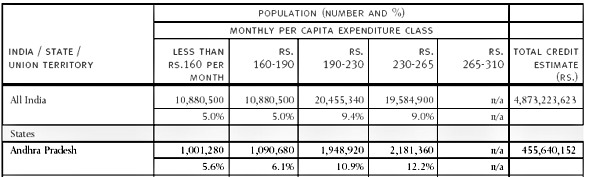

In comparison, a different calculation is possible for the minimum credit necessary to sustain the urban poor. In this method, each state/UTs population below the poverty line is divided into spending classes. The gap between the average spending for a given class and the state-specific poverty line is taken as an estimate of the amount of the funds needed by that population, just to reach the poverty line. For example, the poverty line in Andhra Pradesh was Rs. 278 (1993-94) per person per month. The over 10 lakh urban poor there spent less than Rs. 160 per month (column 2) on necessities and non-essentials. The gap of Rs. 118 is the amount needed by each of those million-plus people to reach the poverty line. Assuming that this difference between required income and actual spending could be made up by micro-credit, the total credit need for people living below the poverty line in Andhra Pradesh is over Rs. 45 crores per month (column 7).

Informal markets offer the urban poor convenient access to money at a high prices and often leads to the poor to be indebted for long periods of time. But the lessons that can be learnt from these informal markets include the importance of simplicity and flexibility, the need for security and that formal market solutions must be prepared to take on the borrowers transaction costs.