The Central Government opened a pandora's box in September with its reported move to table a bill in Parliament aiming to do away with the role of the Comptroller and Auditor General (CAG) for public sector undertakings (PSUs). Soon after the voices of opposition started pouring out from various sections including mediapersons concerned about public finance and accountability, Members of Parliaments, Association of Commercial Auditors and others. Sensing the mood of resistance to the bill form several sections, the Department of Public Enterprises (DPE) sought the opinion of the ad hoc group of experts under former Planning Commission member Arjun Sengupta.

The most recent attempts to clip the CAG's wings were made in 1997, 2001 and 2003. However way back in 1956, in the draft Companies Bill, a proposal was made to keep audit of government companies by CAG as optional.

Reacting to the 1956 proposal, the then CAG V Narahari Rao had stated that it would be a fraud on the Constitution of India, if government companies were not subject to audit by CAG. Upholding the views of the CAG, the Public Accounts Committee in its 3rd Report had observed that the CAG should have unquestioned right to audit the expenditure of these concerns, by whatever name they may be called because they (PSUs) are financed from the consolidated fund of India.

Thus after much deliberations at various forms, section 619 was incorporated in the Companies Act, 1956 clearly providing for the Audit of PSUs by the CAG.

However, writing an opinion for edit page of The Financial Express on 5 December 2005, Arjun Sengupta staged a turnaround saying, "The government is responsible for the operation of PSEs and is answerable to Parliament and CAG. A PSE, with its government majority, is supposed to have as much accountability to a public enterprise monitoring body as a government department." However, he went on to say that in the report 'Empowerment of Public Sector Enterprises' submitted by the ad hoc group of experts headed by him, it is pointed out that in certain areas -- pricing and distribution policies; imports and exports; appointment of dealers and agents; appointment and suspension below board level employees; award of contracts and procurement decisions; selection of consultants and JV partners -- the government should not get involved.

The proposed bill should have triggered a public debate over the accountability of PSUs, shortfalls in their proposed reliance on mere statutory audits, and need to push for rigorous follow up by parliamentary committees. Our pink papers however appear to be trying hard to push the debate over the autonomy being demanded by PSEs to centre stage. In an opinion for the edit page of The Economic Times on 2 December 2005, BJP's Deputy Whip, M A K Swain wrote, "In order to compete globally PSEs must be allowed to take quick and independent decisions with no vigilance, CBI or CAG breathing down their neck True, the CAG is the auditor of the government. But it should not be a captive audit. CAG should compete with other international bidders for auditing the PSUs. Openness in the process of the selection of external auditor will relieve the PSUs of their fear of being burdened with very typical rule and procedure bound government auditors."

Such an opinion put forward by an MP belonging to a national political party raises a serious concern. Audit oversight of government expenditure and PSUs is a mandate of constitutionally established Supreme Audit Institutions around the world and organisations such as INTOSAI (International) and ASOSAI (Asian) have been created to keep these institutions alive and professionally apace with the present. Asking CAG to compete with other international bidders would not only amount to undermining its professionalism, it is also tantamount to undermining a constitutionally established institution.

In an editorial, The Financial Express (November 16, 2005) called this move to do away with CAG audit of PSUs a "welcome relief". This opinion was guided by an understanding that "In many ways, PSUs continued to function in the era of globalisation as in the past, with the Ministry, the Mantri (Minister) and the CAG breathing down their necks. The concept of 'navaratnas' was an attempt to mitigate the former, the decision to scrap supplementary audits by the CAG is an attempt to tackle the latter."

The Financial Express editorial went further to speak in corollary with the remarks of the J J Irani Committee, when it said, "Indeed, no one would argue that audits be done away with. It is a moot point, however, whether any purpose is served by having a multiplicity of audits, as is the practice in PSUs, where the statutory audit by chartered accountants appointed by the CAG is followed by a supplementary audit by the CAG itself. The senior management in PSUs spends valuable time answering endless queries, time that could be better spent attending to operational issues."

But by framing the debate as one of protecting the 'autonomy' of PSUs from 'microcontrol by government', some of our pink papers are trying to confuse readers into believing that CAG audit is a governmental intervention, which it is not. The CAG is a constitutionally enshrined independent authority. CAG audits have highlighted how investment decisions influenced by politicians were clearly non-viable and were not in compliance with the DPE guidelines itself. (MTNL investing in MKVDC bonds under former NDA Minister Pramod Mahajan's instructions.)

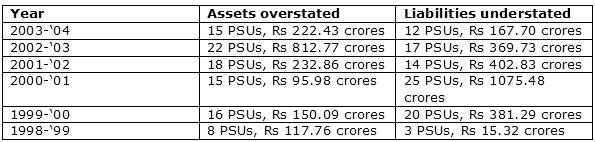

In repeating the reference to CAG audit as introducing multiplicity, the Financial Express editorial tried to lend credence to remarks by J J Irani Committee where the public audit by CAG is referred to as "duplication and superfluous". However, when vetted in the backdrop of the revelations made in past audits by the CAG of PSUs, such an understanding is found out to be clearly misplaced. On matters as basic as profit and loss accounts or balance sheets, CAG audits have repeatedly found fault with statutory audits. And why won't it, when overstating the assets and understating the liabilities have become a habitual malady statutory audits are found to be suffering from.

What CAG audits of just the last six years found

Statutory audits of PSUs by chartered accountants are regularly overstating assets and understating liabilities, despite repeated reprimands during the CAG's supplementary audit which uncovers these financial improprieties.

Statutory audits of PSUs by chartered accountants are regularly overstating assets and understating liabilities, despite repeated reprimands during the CAG's supplementary audit which uncovers these financial improprieties.

Indian Petro Chemicals Limited (IPCL) is a particularly stark case of failure of statutory audit. The CAG's supplementary audit for the year 1998-'99 found out that while the statutory audit indicated a profit of Rs 32.88 crores, CAG's audit scrutiny revealed that the actual position showed a loss of Rs 33.26 crores. This represented a variance of 201 percent in relation to book profits. (1 crore = 10 million.)

In such a backdrop, the debate over the accountability of PSUs and Parliamentary control over them must be centre stage. A resolution passed at a recently held meeting of none other than the executive committee of Association of Commercial Auditors itself reaffirmed this. The association openly stated that audits conducted by the Chartered Accountants of India falls far short of the quality and expertise available with CAG's auditors. It took the view that efficiency-cum-performance audit conducted by the CAG is the tool for Parliament to exercise checks on the activities of government companies. Their resolution went on to say this: "It is our considered view that the CAG should be the Sole Auditor for all govt. companies including its subsidiaries. We are also of the strong opinion that all the public financial institutions viz., LIC of India and all the National Banks should also be brought under the sole audit of CAG."