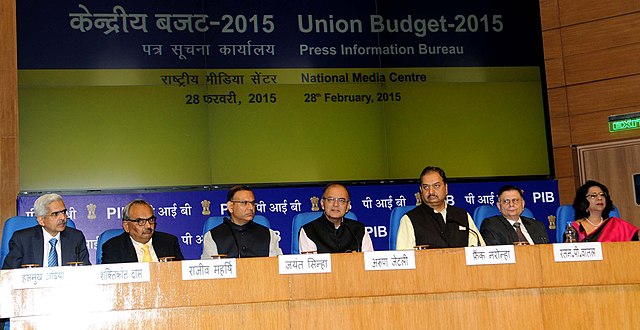

Finance Minister Shri Arun Jaitley has said that the Indian Economy has turned around dramatically in the last nine months with the real GDP growth expected to accelerate to 7.4 percent, making India the fastest growing large economy in the world.

Presenting the General Budget for the year 2015-16 in Lok Sabha today, he said macro-economic stability has been restored and conditions have been created for sustainable poverty elimination, job creation and durable double digit economic growth.

The Minister specifically talked about three key achievements of the Government, the Jan Dhan Yojana which brought over 12.5 crores families into financial mainstream in a short period of 100 days, transparent coal block auctions to augment resources of the states and ‘Swachh Bharat’ which has become a movement to regenerate India.

Jaitley also said that India has now embarked on two more game changing reforms which are GST and the JAM Trinity-Jan Dhan, Aadhar and Mobile-to implement direct transfer of benefits. He added that GST will put in place a state-of-the art indirect tax system by 1 April 2016 while the JAM Trinity will allow transfer benefits in a leakage-proof, well-targeted and cashless manner.

Describing the declining inflation as one of the major achievements of the Government, the Finance Minister said that this represents a structural shift. He said CPI inflation is expected to remain at close to 5 percent by the end of the year which will allow further easing of monetary policy. Jaitley said a Monetary Policy Framework Agreement has been concluded with the RBI to keep inflation below 6 percent.

Pic: PIB

Jaitley said growth in the next financial year is expected to be between 8 and 8.5 percent and aiming for a double-digit rate would become feasible very soon.

The Finance Minister counted five major challenges faced by the Indian economy: stress in the agricultural sector, weak private sector investment in infrastructure, decline in the share of manufacturing in GDP, and a resource crunch in view of the higher devolution of divisible taxes to states and the imperative to maintain fiscal discipline.

Jaitley assured that the country would meet the challenge of maintaining the fiscal deficit target of 4.1 percent of GDP that the Government had inherited. He added that the journey for fiscal deficit target of 3 percent will be achieved in three years, rather than two years.

Jaitley emphasised on the need to cut subsidy leakages, to achieve which the Government is committed to the process of rationalizing subsidies.

Certain key highlights from the Budget:

- Rs 5,300 crore to support micro-irrigation, watershed development and the Pradhan Mantri Krishi Sinchai Yojana

- A target of Rs 8.5 lakh crore of agricultural credit

- An initial allocation of Rs 34,699 crore for the MGNREGA programme

- Creation of a Micro Units Development Refinance Agency (MUDRA) Bank, with a corpus of Rs. 20,000 crore, which will refinance Micro-Finance Institutions

- A soon-to-be-launched Pradhan Mantri Suraksha Bima Yojana that will cover accidental death risk of Rs 2 lakh for a premium of just Rs 12 per year

- Launch of Atal Pension Yojana, which will provide a defined pension, depending on the contribution, and its period

- New Pradhan Mantri Jeevan Jyoti Bima Yojana to cover both natural and accidental death risk of Rs. 2 lakh for a premium of Rs. 330 per year (for the age group 18-50 years)

- Establishment of a National Investment and Infrastructure Fund (NIIF) with an annual flow of Rs. 20,000 crore

- Rs 150 crore for the Atal Innovation Mission (AIM) in NITI which will provide a Innovation Promotion Platform involving academicians, and drawing upon national and international experience

- Five new Ultra Mega Power Projects each of 4000 MWs in the plug-and-play mode

- Proposal to merge the Forwards Markets Commission with SEBI to strengthen regulation of commodity forward markets and reduce wild speculation

- Introduction of a Gold Monetisation Scheme, which will allow the depositors of gold to earn interest in their metal accounts and jewellers to obtain loans

- An additional Rs 1000 crore for the Nirbhaya Fund

- Rs 75 crore for Faster Adoption and manufacturing of Electric Vehicles

- An IIT to be set up in Karnataka and Indian School of Mines, Dhanbad to be upgraded to a full-fledged IIT

- All India Institutes of Medical Sciences (AIIMS) to be set up in J&K, Punjab, Tamil Nadu, Himachal Pradesh and Assam and one more AIIMS like institution will be set up in Bihar

- New IIMs in J&K and Andhra Pradesh

- Goods and Services Tax (GST) to be operational from April 1, 2016 and to be applied prospectively

- Allocation of Rs 2,46,727 crore for defence

- Reduction in corporate tax from 30 percent to 25 percent over the next four years

- A comprehensive new law on black money to specifically deal with such money stashed away abroad

- Quoting of PAN being made mandatory for any purchase or sale exceeding the value of Rs.1 lakh

- General Anti Avoidance Rule (GAAR) will be deferred by two years; it will apply to investments made on or after 01-04-2017, when implemented

- Basic custom duty on certain inputs, raw materials, intermediates and components in 22 items to be reduced to minimise the impact of duty evasion

- Wealth tax to be abolished and replaced with an additional surcharge of 2 per cent on the super-rich with a taxable income of over Rs 1 Crore annually

- Education cess and the Secondary and Higher education cess to be subsumed in central excise duty (the general rate of central excise duty of 12.36 per cent including the cesses will be rounded off to 12.5 per cent)

- 100 per cent reduction for contributions, other than by way of CSR contributions, to the Swachh Bharat Kosh and Clean Ganga Fund

- No change in the rate of personal income tax

- Increase in the limit of deduction in respect of health insurance premium from Rs 15000 to Rs 25000 (Rs 30000 for senior citizens)

- Additional deduction of Rs.25,000 for differently abled persons under Section 80DD and Section 80U of the Income-tax Act